Every so often we come across a piece of software or a product that we instantly know we’re going to use.

A month ago after extensive research looking for a product to help manage our finances – I came across You Need A Budget aka “YNAB” after continuously seeing it referred to as an amazing budgeting app.

I drilled down a little further and decided that I was going to give the free 34 day trial a test run.

Two days later I went ahead and bought a full licence for a one-time fee of $60 as it just blew me away.

Here’s a little in-depth YNAB review that will hopefully give you a better insight into this wonderful piece of software.

What’s it all about?

YNAB is a budgeting app which undoubtedly helps users create, track and maintain a budget which is based on YNAB’s four simple rules (more on these rules later).

The software syncs over to all your devices and has a mobile app that makes keeping things up to date a breeze.

Why do you need a budget?

Everyone hates the big “B” word and we were no different. For the past two years we’ve been making our income solely online, and while we always kept a spreadsheet of our income, we never really scrutinised our expenses.

We never knew how much we were spending on different things because we just didn’t want to know basically.

However, this can ultimately lead to disaster in the long-run and that’s why I wanted to find a solution.

I wanted something that would be extremely easy to use while providing enough flexibility when it comes to budgeting.

YNAB provides just that.

So, how do you know if you’d actually need a budget planner like YNAB?

If you can answer a YES to ANY of the questions that follow, then you most certainly need a budgeting tool.

1. You experience financial pressure or anxiety from time to time?

2. Every now and again you have an emergency expense that you hadn’t planned – health issues, your car breaks down?

3. You keep using your savings account to pay for this month’s expenses?

4. You have zero idea about how much money you spend on eating out, buying new clothes or on groceries each month?

5. You’re never able to save up enough money for that big luxury purchase, so you whack it on the good old credit card?

In order for you to gain complete control of every aspect of your finances, then the very first step is to give your money different jobs to complete.

In today’s digital age, money is moving rapidly and if don’t tell it where to go, then the likes of Ebay, Amazon, coffee shops and restaurants will zap it away from you.

Before using YNAB, we never consciously tucked €300 each week into our savings account, but we definitely have donated more than that on the likes of Amazon and Ebay etc..

So, as I said, having complete control and awareness of your money is crucial to keeping you on track with your finances.

The YNAB Method

I mentioned earlier about the four rules that YNAB is based on.

These rules are:

1. Give every dollar a job

2. Save for a rainy day

3. Roll with the punches

4. Live on last month’s income

Let me break these rules down and explain them to you so that you can follow along and understand what I mean.

1. Give every dollar a job

This simply means that when you have money at your disposal (in your checking account, paypal etc) – you give it a job. You budget it into categories.

So instead of deciding to buy something solely on the balance in your checking account, you decide whether you buy it based on your category balance.

Here’s an example of what I mean:

Without implementing Rule 1:

You look and see that you’ve €500 in your checking account. You think you’ve a nice chunk of change to play with and go out on a bender with your mates and blow €100 that night and another €50 the following day eating junk hangover food and heading to the cinema.

A few days later a couple of bills arrive and you’re feeling the pinch.

Implementing Rule 1:

You have €500 in your checking account. You allocate every euro a specific job by dividing the money into various categories:

€200 for car payment

€100 for utility expenses

€100 for food

€50 for eating out

€50 for entertainment

Total € budgeted = €500

You’re debating whether or not to go out on the town. Instead of checking your “balance”, you check your “entertainment” category balance and see that you’ve €50 allocated for this.

A few days later, those bills arrive and you can pay them and you don’t even notice the money going – simply because you budgeted for them!

2. Save for a rainy day

The second rule makes sure you look to the future and plan for those large, less-frequent expenses like Christmas, birthdays, insurance, holidays etc. If you don’t plan for these “rainy days”, then you could be in a world of hurt when the time comes.

Example of Rule 2 in action:

Without implementing Rule 2:

You’ve €1,000 in your checking account.

You do some quick calculations in your head (bad mistake) and remember the electricity bill of €100 is due in a few days and the car payment is also due in two days – another €300. The fridge (food) needs replenishing for €200 and the cable tv bill also needs paying for €100. Disaster.

Total bills = €700 (in your head)

You now think you’ve €300 to go out and blow.

The following week you’ve got €100 in the checking account (as you’ve gone out on a bender with your mates and bought some new unneeded clothes for €200).

The car insurance payment “unexpectedly” arrives.

You owe them €500.

You dig inside those pockets and only find €100 lying about.

You start to STRESS and put the payment on the credit card and dig yourself into a deeper hole.

You make “plenty of money” – but how come you’re in this position?

Implementing Rule 2:

You’ve been planning for a few months in advance. You knew that the car insurance was due in five months time.

You knew it was going to cost you €500 for the year.

So, being budget savvy, you’ve budgeted €100 each month into your “Car insurance” category for the past five months.

You may be thinking where did this extra €100 per month come from? As I mentioned in Rule 1: You give every Dollar/Euro a job. That way your money is obeying your orders. It goes where you tell it to and waits for the time when it’s called into action.

So, five months later, your car insurance bill comes and you pay it, again without even feeling it (because you were prepared for it).

If you hadn’t planned for that expense, then you would have panicked and been unprepared for the large expense.

The whole thing felt extremely normal – to the extent of being a little boring. (which is a very good thing by the way)!

3. Roll with the punches

When you overspend in one of your budget categories (and you will), you adapt or “roll with the punches”.

You will make and change your plans all the time. This is normal and perfectly natural.

If you planned on going to the beach for a day but it’s raining cats and dogs, do you still go anyways? Of course you don’t.

Your budget is no different when it comes to adapting to your plans and circumstances.

So, if you overspend in one category – say you felt more adventurous than usual and went out two nights at the weekend instead of the one – you simply look through your budget and move some money from another category into the one that you overspent in.

Remember – your money works FOR YOU. You’re THE BOSS. 🙂

Seeing this in action:

Without implementing Rule 3:

You feel that budgets don’t work and are a waste of time. This idea of watching what you spend is nonsense.

You “don’t need a budget”. If only you earned more money, you’d be fine.

More money DOES NOT help with money management issues!!

Implementing Rule 3:

Your budget politely informs you that you went over budget in your “Groceries” category.

Not a problem.

You move some money from your “Clothing” category into the “Groceries” to make up the difference.

If you don’t make any adjustments, YNAB will automatically deduct the overspending from next month’s money.

Budgets DO work!

4. Live on last month’s income

This rule is the end goal of YNAB – you spend this month, what you’ve earned LAST month!

How do you do this you may ask?

You save enough money so that you can go a full month without touching the regular income you make.

So, when next month comes, you spend last month’s income while earning this months income!

Without implementing Rule 4:

You live paycheck to paycheck. You know the date of your next paycheck in advance and you’ve a load of bills that will be paid as soon as you receive the paycheck.

This is stressful as your bills get paid once your money hits your account. You’re juggling due dates with cash flow and other unexpected expenses (rule 2).

It’s a constant cycle of stress that eats away at you.

Implementing Rule 4:

You’ve built up a month’s worth of income that you’ve saved in your buffer category.

When your bills arrive, you pay them there and then.

You don’t have to worry about when the next paycheck will arrive because you’ve got the money there waiting to do its job!

You’re never stressed because you’re prepared and you’ve budgeted efficiently.

So there you have a quick explanation of the methodology that YNAB uses. If you’d like to find out more detailed information about each rule, then you can visit their site.

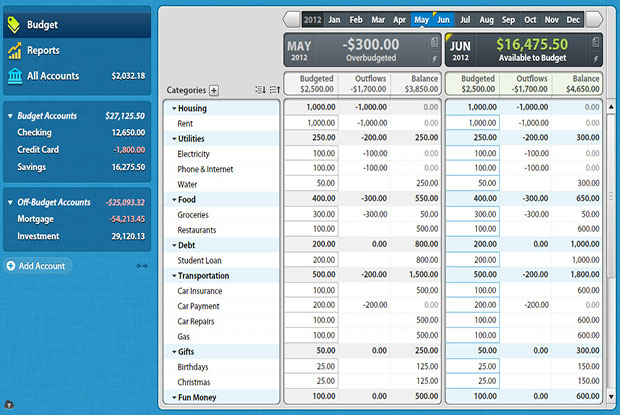

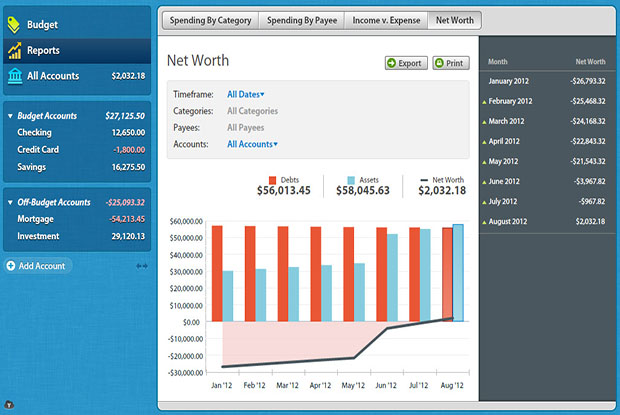

Reports

Having the ability to generate in-depth reports on your spending and budget is something that I absolutely love.

I’m a “stats” guy and I love being able to quickly see at a glance where the money is going and how much of it is going there.

YNAB offers a really cool report feature.

You’ll be able to view reports about spending by category, payee, income vs expense and net worth.

If you want to know how much you spent on groceries last month (or in total), then that info is easily available at the touch of a button.

These reports are a great way to give yourself a quick reality check when you first start using the application.

In the first few weeks of using YNAB we discovered that we spent a huge chunk of money in cafes! No surprises there though!

I know a lot of people probably don’t like knowing how much they spend here and there, but once you let go of these inhibitions, you’ll be amazed at what the stats say!

Cloud-Sync

Being able to carry your virtual budget in your pocket with you makes sure that you keep things up to date. YNAB’s cloud-sync capability will prevent you from trying to remember whether or not you’ve X amount of money available in a certain category.

Whenever you make a transaction, you just pull out your smartphone and record the details. The information is instantly updated across all your devices (or it does once you connect to the internet if you’re offline).

Is YNAB worth buying?

As you can see on our blog – there’s actually very few products that we actually endorse or recommend.

However, YNAB is a product that we feel can change the way we manage our money.

The software takes about a day or two to get to grips with, but once it clicks with you, you’ll love it.

We’ve been amazed at the benefits of having such a powerful, yet simple, piece of software at our disposal. It has opened our eyes to potential money holes that we’d otherwise been oblivious to.

The one time fee of $60 will end up saving you literally thousands each year if you stick by their four rules.

Get a 10% Discount

If you use the link below, you can save yourself 10% when you buy YNAB.

Get 10% off

You can also try out their 34 day Free trial.

What others have to say about YNAB

YNAB also supports a full-blown community of people all using the software to change their financial lives for the better. I’ve talked with many of them in the forums over the course of the past month since I joined and here’s what a few of them have to say about YNAB;

“We are still fairly new to YNAB, but it has already helped us reduce frivolous spending, save more, and increase our net worth by hundreds–nay thousands–of dollars. We are seeing big strides every month. Before, we could only make tiny dents…and our progress quickly faltered with every surprise bill.” -E. C.

—

“Before YNAB I wasn’t in horrible financial shape…my only debt was a relatively small mortgage, I paid my bills on time and I had some retirement savings. But despite a steady rise in my income over the past 10 years or so I wasn’t seeing a lot of benefit from the extra dollars. I think I had taken the term “disposable income” to heart by frittering away any money that wasn’t immediately needed for a bill or a mortgage payment. Using YNAB has given me an insight into my spending habits and made me much more mindful of choosing a sensible place for those ‘disposable’ dollars to go. I now have a plan to pay off my mortgage within three years (versus the 7 and a half that was scheduled) and am saving for things more worthwhile than a daily latte. I’m even contemplating early retirement!” Cheers, Bernadette in Australia

—

“YNAB is not just a budgeting tool, but an entirely new way of looking at how I spend my money–and a good new way at that! I no longer rely on credit cards for big purchases, and although I’m not swimming in cash, I don’t feel the pressure of living that dreaded paycheck to paycheck lifestyle anymore. YNAB has given me peace of mind that I can afford to live the life I want while tackling my student loans and saving for the future. It’s a complete game-changer and my finances are no longer a source of stress.” -Stacie M.

—

“Before YNAB, I never really knew if we could afford something, it was really just a guess – and not a very educated one at that! Now that we have a plan for how we want to spend our money, it’s much easier and less stressful to make spending choices.”

—

“I wasn’t exactly bad with money, but I didn’t quite hold onto it well either. We weren’t swimming in debt but we weren’t making headway. I didn’t understand why we were struggling. You can rationalize plenty of bad habits when you don’t see the bigger picture. Each purchase is a thread in the larger tapestry of your finances and, indirectly, your life. YNAB is a budgeting tool, an excellent one, but it’s also been the equivalent of a no punches held financial adviser and friend who speaks so little yet so much. The effect on my my life has been better sleep, less anxiety, more happiness. Less valleys and mountains, more calming plateaus. It sounds dramatic because it is.” ~ E.B.

—

“My husband and I used to budget with a beast of a spreadsheet that I built to simulate Dave Ramsey’s envelope system. It was exhausting to set up for each new pay period, there was minimal reporting, and worst of all, any budget adjustments were calculated as an expense and an income. Heaven help us if I ever needed to set up a new category. YNAB’s interface and tools are clean, simple, and flexible. It only took a few minutes to set up, the master and sub categories are a breeze to create and reorganize, and we can adjust our budgeted amounts over the course of the month without fear.” KA

—

“I am also a new YNAB user and just finished up the free trial period. This software is just fantastic that I bought it with a referral code. I was going to wait for a “sale” but you know I also wanted to support the team that created such a fantastic budgeting tool. I was not horrible at budgeting, I mainly kept with how much I spent, but with YNAB it makes me think about what I will spend the money on rather than seeing how much I’ve spent vs income. I like the fact that I budget a couple of months ahead and seeing how much I truly have to spend. Obviously I don’t have as much as I think I have, seeing it goes to zero fairly quickly. but that’s the great thing about YNAB you think you have so much but after you budget to zero to see where you are at it’s an eye opener.”

—

“I started out budgeting with a subscription based website, which worked, but was rather clunky, and caused recurring expenses to boot. Prior to YNAB I had my budget in one place, and then I had a separate spreadsheet of the leftovers in each category from previous months, and then I also had to keep an account register, because hey, who wants to risk over-drafting when the renter’s insurance (annual), the car insurance (semi-annual), and rent (monthly) are all supposed to get paid? After all, when budgeting I’m supposed to guess how much I’m gonna make this month and budget that, right? (Um, no. Not the best way to operate, thanks YNAB!)

I was poking around looking for other options when my subscription was running out and ran across YNAB. I love the way category balances roll from month to month, and having all the category names as well as the master category names customizable, as well as how many of each there are, is very helpful for keeping things organized. Also, the YNAB team recommends only budgeting with money I have in my hand, right now, which means that I shouldn’t ever run into that overdraft situation I was worried about before.”-TheTabby

—

Disclosure: We are an affiliate for this product. If you purchase this product through one of our links, then we will earn a commission. However, you will not pay more when buying a product through one of our links. In fact, sometimes we’re able to negotiate a lower rate for our readers.

Have any of you used YNAB? If so, what has been your experience with it? We’d be interested to hear your thoughts in the comment section below.

Interesting to read this Carlo. I just tried YNAB, and I didn’t really get on so well with it, mainly because my income is so peaks and troughs – it’s so hard to predict what I will actually earn in a month. How did you manage that aspect? Do you know what you will earn each month? I also found that my expenses are really variable because I’m in different countries, doing different things. Would be interested to hear your perspective.

Hi Ellen,

This is exactly why YNAB is perfect for us freelancers. Remember the YNAB only wants you to budget that money that you have available right now.

It doesn’t work if you use it as a prediction or forecast – that’s not how the model works.

We’re in the same boat regarding not knowing how much money we make each month – so all we do is budget the money when it comes in and adjust things from there Ellen.

As you know we’re always on the move too in different countries etc, so this works extremely well for us. It’s all about prioritising your money.

I would strongly suggest you look at the training videos, as they really iron out the whole methodology for you.

It’s so great to know that bills are taken care of without wondering/remembering if you’ve budgeted for them etc.

Really can’t speak highly enough of the software though – it does take a little getting used to. But now, I just pull out my phone whenever I buy something – pop in the transaction amount and categorise it and it tracks everything.

Let me know if you need any more info Ellen – I’d be happy to jump on a skype call if you needed anything clarified.

Thanks Carlo, very interesting to get that perspective. I did watch the videos and go through the details, but it hasn’t gelled with me yet. But very helpful to know that other freelancers are using it – I know you guys have a similar lifestyle so quite helpful to see others in the same boat finding it useful!

Hopefully catch you in the new year in Thailand 🙂